Wednesday, July 31, 2013

Rate Changes Are Coming

Companies will send the letters to policyholders at least 60 days prior to the policy renewal date to announce rate changes effective October 1, 2013. The changes will affect certain pre-FIRM properties, which are older buildings constructed before the community joined the National Flood Insurance Program and adopted its first Flood Insurance Rate Map (FIRM). These include properties in most high-risk A and V zones, as well as undetermined-risk D zones.

The letters explain that the Biggert-Waters Flood Insurance Reform Act of 2012 (BW-12) requires the phaseout and removal of subsidized rates. Two types of rate changes will be announced:

A 25 percent rate increase will be applied at renewal for business and other non-residential properties, properties that have experienced severe or repeated losses, and non-primary residences (this increase began in January 2013).

A direct move to full-risk rates will be applied at renewal for a building purchased — or a newly purchased policy with an effective date—on or after July 6, 2012, the date the law was signed. Lapsed policies reinstated on or after October 4, 2012, also will move directly to full-risk rates. The policyholder will be asked to submit a renewal application with additional information, including an Elevation Certificate, so that the building can be elevation rated.

www.floodsmart.gov

Friday, July 19, 2013

Where would they be — without you?

Earlier this month, we celebrated our independence as a nation. Perhaps because we were founded by rugged individualists, many of us still tend to expect a lot of independence of ourselves — and others — on a personal level.

One way you can help your family maintain its independence if anything happens to you is by having life insurance. I can show you several options that may help ensure your family can maintain its current lifestyle.

Life insurance is one of those products you buy and hope never to need. But if anything happens to you, having life insurance could be an enormous relief to your family. Consider these questions:

1.Could your family keep up the house payment/rent, car payment and other expenses without your income?

2.Could your children get the education you want for them?

If your answer was “no,” then you may want to consider life insurance.

Another significant reason to have life insurance is to help pay for your final expenses. The typical cost of a traditional funeral and burial1 today is about $10,000, and even cremation is likely to run from $2,000 to $4,000.2

If you prefer that your spouse and loved ones not bear the burden of costs like this, you may want to consider the Farmers Graded Death Benefit Whole Life policy*. It’s available to people up to age 80, and no medical exam is required. And, as a Farmers customer, you may be eligible for discounts.

Call me today; I can show you options for your individual situation and life stage. The cost of having this peace of mind may be lower than you expect.

Monday, July 1, 2013

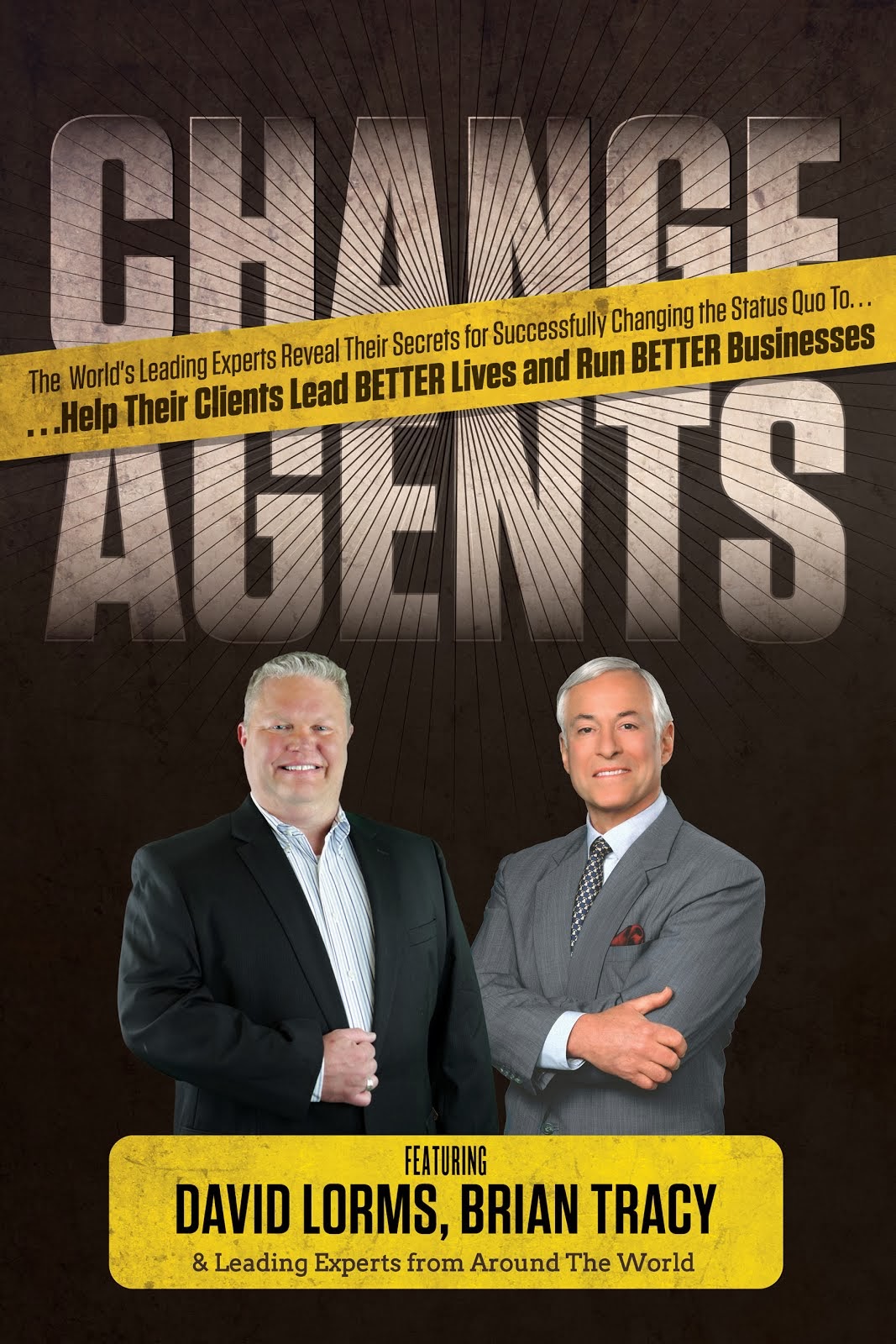

Insurance Expert David Lorms Signs Publishing Deal With CelebrityPress For New Book, “Change Agents”

David Lorms will team with CelebrityPress, a leading book publishing company, and several leading business professionals from around the world to release the book, “Change Agents.”

Houston, Tex. – June 28, 2013 – Insurance expert David Lorms, has joined a select group of the world’s leading experts to co-write the forthcoming book titled, Change Agents: The World's Leading Experts Reveal Their Secrets for Successfully Changing the Status Quo to Help Their Clients Lead Better Lives and Run Better Businesses. Nick Nanton, Esq., along with business partner, JW Dicks, Esq., recently signed a publishing deal with each of these authors to contribute their expertise to the book, which will be released under their CelebrityPress imprint.

David Lorms is a Farmers Insurance Agent in Houston, TX. His prior work included experience in sales and insurance claims giving him a solid background for becoming an Insurance Agent. He has won numerous awards including the Blue Vase and Toppers Club. David is heavily involved in his community as a member of his Home Owners Association, an Usher at his Church, and donating time and money to several local Elementary, Middle and High Schools. One program he is proud of is his creation of awarding students for perfect attendance with bikes, medals or other items deemed appropriate by the school. David is also involved in the March of Dimes, AIDS Walk, and Cell Phones for Soldiers, a program that collects old cell phones to exchange for minutes for soldiers to use to call their family.

Descriptively known as Agents of Change, the Celebrity Experts® in Change Agents seek to make new inroads into the fields of expertise they represent. They have attained success by changing both themselves and the world around them to some degree. Never afraid of change, however difficult, they know that they will never enjoy the sweet taste of success only doing what everyone else does.

The royalties from this project will be given to Entrepreneur’s International Foundation, a not for profit organization dedicated to creating unique launch campaigns to raise money and awareness for charitable causes. The book is expected to be published in September 2013.

Subscribe to:

Posts (Atom)